Tuesday, December 27, 2022

Lightning Strikes Coale Twice?

Sunday, November 6, 2022

The Incidence of Intellectual Diversity

We now have lots of measures of diversity in the academy, by which I mean heterogeneity in race, gender, geography, political attitudes, etc. At this weekend's Stanford Conference on Academic Freedom, much discussion focused on the chasm between the political composition of the academy and the general population. A debate ensued as to whether/how this is related to academic freedom and whether/how public policy should advance affirmative action for "deplorables" (we deplorables use that term affectionately).

Such regulation is likely dangerous and imprudent, in part because the incidence of such diversity is poorly understood. Small, and not necessarily frequent, voluntary actions can make a big difference.

I first noticed this as a college student circa 1990 when political correctness was surging. Moreover, the large majority of my college classmates were quite unserious about academics, putting more time and effort into various extracurriculars and activism (South Africa was one of the big topics). But adapting to the latter was pretty easy. I fulfilled distribution requirements by taking courses like physics and computer science with the respective majors rather than the general ed versions that were watered down by popular demand. I took many economics courses in the graduate schools and over at MIT.

While extremely serious about their studies, the graduate students were politically correct too. More salient to me was a fair bit of group think around both policy and technical issues. It seemed to me that they too uncritically accepted the Keynesian visions of much of the faculty. Dynamic programming was nonexistent until Benabou (MIT) and Leahy (Harvard) came to town during my senior year, and still was quite a niche topic. With some effort I found Stokey-Lucas-Prescott at Harvard Press, but I searched what seemed like every bookstore in the greater Boston area for Sargent's Dynamic Macro Theory (also a Harvard Press book) until finally acquiring a copy during a Christmas-break-blizzard trip to the Seminary Coop in Chicago.

During a typical day on campus I would attend class, say, asking Professor Larry Summers something like "the trade deficit is a real variable -- why should nominal variables like currencies be our primary explanation of why they change over time?" [He and Feldstein were teaching that the U.S. trade deficit had to decline, which required a significant depreciation of the US $ especially vs the yen]. Summers especially would often provide a mocking answer, typically provoking a hearty laugh among my classmates.

Here Robert Barro made a big difference without necessarily much effort [he invested in us students in many other ways too, but that is another topic]. The small number of students (of various ages) with interests closer to mine ended up working with Barro, and that's how we students met each other. Barro had an extra desk on the second floor of NBER that I shared with Xavier Sala-i-Martin, Randy Kroszner, and (at various times) Michael Kremer, Serge Marquie, Jaume Ventura, and Holger Wolf. After classes I would go to the NBER and recount my classroom exchanges with Xavier, Randy, etc. With them as a friendly sounding board, I suffered no harm from Summers' nonanswers [see also the sequel in WSJ and WaPo]. Quite the opposite. Their support helped me learn to stand on my own, and helped me find the few dynamic programmers in town (Barro would take several of us to Hoover one summer where I also met Sargent, McGratten, Judd, and others with overlapping interests). I was learning that even the "smartest" people at the best universities had vulnerabilities in their arguments, which were betrayed by a refusal to engage.

The lesson here is that faculty can help a lot just by helping students find each other, especially on intellectual dimensions like those mentioned above. As long as the intellectual minority is not so small as one, they can get a better education than the majority do. Sheer numbers automatically exposed me to the group think, while just a few minority friends can be enough to facilitate engaging alternatives. The raw distribution on campus need not be anywhere near the population distribution for at least the minority to benefit from intellectual diversity.

Several of the participants at this weekend's conference reported similar experiences. Being alone is tough, but a few sympathetic colleagues go a long way. Indeed, having the conference helped with that too. The sorting aspect reminds me of Milton Friedman's description of the formation of the Mont Pelerin Society in 1947, which seemed quaint and anachronistic in 1998 but suddenly now needed as much as ever.

To be clear, my classmates did not gang up on me for being skeptical of the prevailing views. Politically incorrect views did occasionally spawn cancellation campaigns, although not as frequently as today. Certainly numbers play a role in mob rule, although even today the mob itself is already a minority, albeit outspoken.

Thursday, July 28, 2022

Contents of the "Inflation Reduction Act"

Please let me know how this so-called "Inflation Reduction Act" reduces inflation. Here's what's actually in it:

Major items

- Alternative minimum tax for corporations Sec 10101

- This raises the level of business taxation, which reduces real wages.

- IF it reduced the dispersion of business taxation, that would be a force toward increasing real wages to help offset the level effect. BUT see below on the dozens of IRA provisions that increase the dispersion of business taxation.

- Gives the Treasury Secretary the authority to determine an individual corporation's tax liability! Sec 10101 (a)(2)(C), (a)(13)

- [I changed my mind: I want to be Treasury Secretary!]

- Close the "carried interest loophole" Sec 10201

- $80B for IRS Sec 10301

- 3 types of drug price controls

- Prices set by HHS for selected Medicare drugs Sec 1191 [I think the Senate typist meant Sec 11091]

- Inflation rate cap for Part B drugs (obtained at hospitals and clinics rather than pharmacies) Sec 11101

- Inflation rate cap for Part D drugs (obtained at pharmacies) Sec 11102

- Medicare Part D (i.e., drug plans for seniors) insurance-benefit floors and reduced subsidy rates Secs 11201-11202, 11401

- Both benefit floors and subsidy-rate cuts will increase Medicare Part D premiums. The net result could be more subsidy $ and more drug-plan expenses for most seniors.

- One insurance-benefit floor (Sec 11201) requires that enrollees have 100% of their pharmacy bill covered after they have spent $2k for the year. Another (Sec 11202) does the same on a monthly basis (roughly $150 per month).

- A third insurance-benefit floor is for vaccines Sec 11401

- Zero is a dangerous number for a price!

- The 80% Medicare subsidy associated with these transactions is cut sharply. This by itself would reduce distortions in the program.

- Remember that Part D premiums are already about 75% subsidized. At that rate (which will increase -- see below), the government expense for Part D could well increase.

- Increases in subsidies for Medicare Part D premiums Sec 11404

- Specifically, expanding eligibility for "low-income" premium subsidies

- Budget gimmick courtesy of Alex Azar: repeal rebate rule Sec 11301

- This rule would have prevented drug manufacturers from competing for Medicare Part D business by offering rebates, thereby sharply increasing Medicare Part D premiums and the government's Part D expenses.

- On paper, repealing this rule would reduce the federal deficit. However, many expect that the rule would be struck down in court (regardless of whether the IRA repeals it), especially now that agencies have less latitude in reinterpreting statutes. Hence this savings is a budget gimmick.

- I explain in Chapter 10 of yourehiredtrump.com how HHS Secretary Azar concocted this rule. We warned him and Trump that Democrats would, via a budget gimmick like this, use the rule to "fund" their big-government programs.

- Extend the "temporary" Obamacare expansions that were put in place during the pandemic Sec 12001

- Clean energy tax credits Secs 13101-13802

- 291 pages of the Green Dream!

- Interestingly, Sec 13105 increases credit for nuclear power plants, but just those already built. Intended to slow down nuke-plant closures?

- Otherwise "clean" refers to the various technologies that are in vogue, including bio fuels and battery manufacturing

- Get a tax credit for purchasing a used Electric Vehicle Sec 13402

- $4K or %30 of sale price

- But only for households with AGI less than $150K and EVs selling for less than $25K

- Must go through a car dealer

- Limit of one credit per vehicle lifetime

- Limit of one credit per taxpayer per 3 years

- As a result, the federal government will be granted EV credits when:

- EVs are produced,

- EVs are sold new, and

- EVs are sold used

- $20B for agricultural conservation programs Secs 21001 and 21002

- Appropriations for clean energy programs ($80-85B total)

- Another 100+ pages of the Green Dream, not to be confused with clean energy tax credits (291pp).

- $2B subsidies for "Electric loans for renewable energy" Sec 22001

- Biofuel subsidies Sec 22003

- $10B for rural electric cooperatives Secs 22004 and 22005

- $15B for Greenhouse Gas Reduction Fund Sec 60103

- $1B for HUD clean energy projects Sec 30002

- $3B for NOAA climate resilience projects Secs 40001-40007

- $10B to subsidize switching from natural gas appliances to electric Secs 50111-50123

- $1B to subsidize zero building energy code adoption Sec 50131

- $14B for DOE loans and grants Secs 50141-50145

- $3B for electricity transmission subsidies Secs 50151-50153

- $6B for the Office of Clean Energy Demonstrations Sec 50161

- $2B various other DOE Secs 50171-50173

- $1B for clean heavy-duty vehicles Sec 60101

- $3B for clean energy programs for ports Sec 60102

- $6B for various pollution-reduction programs Secs 60113-60116

- $3B for Environmental and Climate Justice Grants Sec 60201

- $5.5B for various other clean energy/environment Secs 60502-60506

- $3B for USPS clean fleet Sec 70002

- Taxing fossil fuels

- Increase royalty rate on offshore oil and gas by about 4 percentage points Sec 50261

- Increase royalty rate on onshore oil and gas by about 4 percentage points Sec 50262

- Both royalty rates are expanded to flared gas Sec 50263

- Methane Emissions Charge Sec 60113

- Permanent extension of tax on coal Sec 13901

- Roughly $1 per ton. For context, coal prices were sometimes below $50/ton before the pandemic

- Eliminating cost sharing for vaccines in Medicaid and CHIP Sec 11405

- Changes to Medicare payments for biosimilars (Secs 11402 and 11403)

- Reinstate superfund Sec 13601

- Research credit for small businesses Sec 13902

- $5B for forestry subsidies Secs 23001-23005

- $0.5B to further carry out the 1950 Defense Production Act Sec 30001

- $1B for National Park Service and Bureau of Land Management Secs 50221-50223

- $0.6B various water Secs 50231-50241

- Regulation of offshore wind leasing Sec 50251

- Some kind of extension of offshore leasing program Sec 50264

- Limit encroachment of offshore windmills onto areas under lease for offshore drilling Sec 50265

- Various other DOE and DOI Secs 50271-50303

- Various other EPA programs (less than $1B) Secs 60104-60112

- Small amounts for Council on Environmental Quality Secs 60401-60402

- $4B for Endangered species programs Secs 60301-60302

- $2B for Neighborhood Access and Equity Grant Program Sec 60501

- Various other Sec 70001, 70003-80004

Tuesday, June 28, 2022

How Incumbents Capture Price Controls: Example from the U.S. Senate

U.S. Senators are proposing to put both retail and business-to-business price controls on insulin. The (intended?) result will that be that consumers will pay more, diabetes complications will get worse, and incumbent manufacturers will make more money.

Drugs generally follow a life cycle. Unique new drugs often command a high price that soon falls sharply as the incumbent faces competition from alternative therapies and/or generics. Insulin has the same kind of life cycle. Two biosimilars (essentially a generic version of a biologic, which is a more complicated type of drug) were quickly approved under one of the new approval pathways created by the Trump Administration that helped bring prices down (explained further in my forthcoming Journal of Law and Economics paper). Seven more biosimilars are in the approval pipeline and will soon be competing with the incumbents.

The incumbents would like to freeze time before those competitors arrive, and Senators Shaheen and Collins are obliging. While they advertise freezing the retail price at $35 plus inflation, they will also impose price controls on the business-to-business transactions that new entrants use to break into the market (read more about them in Chapter 10 of http://yourehiredtrump.com, or in Chapter 13 of my favorite textbook, or in the analysis by OACT and CBO). By hindering the entry and diffusion of the new biosimilars, the price of insulin will not fall as it would have, and usually does over the drug life cycle.

Suppressing competition is exactly what I'd expect Big PhRMA to order up on the Congressional menu (again, see Chapter 10 of http://yourehiredtrump.com). I am less surprised than anyone to again see PhRMA deploy Karl Marx's rhetorical device (he always decried the "middlemen" of capitalism), "This legislation rightly recognizes the role of insurers and middlemen" as they see a PhRMA-protection bill come together.

Consumers will have less choice and pay more as a result of this bill. Adherence to diabetes treatments will be worse than it would have been if this bill were not getting in the way of competition. Low adherence is not just a health problem, but a financial problem too as private and public health plans are saddled with additional hospitalization expenses for treating diabetes complications.

Monday, June 27, 2022

The Hidden Increase in Capital Taxation

The taxation of business income is now increasing significantly, without any action from Congress. The increase can be understood as two forces acting through one simple formula.

For tax purposes, depreciation is a statutory time path of deductions from a business' taxable income for each dollar invested in a real asset. The path is called "depreciation" because the undiscounted present value of that time path is equal to one. That is, 100 percent of every dollar invested will someday be available as a deduction.

One simple formula representing two shocks: D/(D+R)

An important reason that business-income taxation distorts investment is that business owners evaluate time paths at a discount rate R > 0. Therefore, in present value, only a fraction (z, in the usual notation) of investment is deductible from taxable income.

With constant depreciation (D) and discount (R) rates, z = D/(D+R) <= 1. This simple formula captures two things going on right now in the U.S.: the sunsetting of TCJA's bonus depreciation and inflation. (The former is specific to the U.S. but the latter is relevant for those nations that also tax business income while allowing depreciation deductions).

TCJA allowed the expensing of some investment, which makes z = 1 (think of expensing either as R = 0 or infinite D). Expiration of expensing pushes z below one.

The depreciation schedule is a nominal time path; depreciation allowances are not indexed for inflation. Therefore the appropriate discount rate R is a nominal interest rate. Clearly nominal interest rates have increased over the past year and a half (inflation!), which reduces z in all but the expensing case. Indeed we can ignore the expensing case if we take the sunsetting first and then add in inflation.

Quantitative results

In order to translate reductions in z into increases in the effective real price of investment, I use a special case of the Hall-Jorgenson formula, where the pre-tax real price is inflated by the tax factor (1-tz)/(1-t) <= 1, were t is the statutory rate of taxation of business income (Cohen, Hassett, and Hubbard consider the more realistic, but also more complicated, cases). The equality holds only when z = 1 (i.e., expensing).

The chart below shows the relation between the nominal interest rate R and the tax factor. We start close to the origin with low inflation and bonus depreciation. Sunsetting by itself moves off the origin to (pre-inflation) R of, say, 2-3%/yr. That is about a 7 percent increase in the real price of investment.

Next inflation increases R. So far annualized R appears to have increased about 2 percentage points although there are concerns that it could increase more (presumably it would increase close to 1-for-1 with inflation if inflation were expected to be permanent). That increases the real price of investment another 4 percent or so.

Inflation further increases the real price of investment due to personal income taxation, especially to the extent that personal income is taxed at higher personal rates than business income is. On the other hand, the sunsetting of expensing is not relevant for structures because they did not get bonus depreciation. So perhaps all three effects combined increase the price of investment 15 percent, with about half specific to TCJA.

Oil and gas

Oil and gas extraction is particularly capital intensive. Using a capital share of 71 percent, that suggests an 11 percent shift (upward) in the marginal cost for that industry, with about half due to TCJA subset and therefore not shared by foreign producers of oil and gas.

Comparing the period of the Biden presidency (Feb 2021 - Feb 2022, which is latest available) to 2018-19, inflation-adjusted world oil prices have increased 20-25 percent while US O&G industry marginal cost has shifted up 11 percent. That by itself would blunt much of the supply response. Then add:

- new threats of federal energy and banking regulation,

- threats to increase the statutory rate on business income, and

- the effects of ESG investing that increasingly stigmatizes investment in fossil fuels,

Thursday, June 16, 2022

Recession Time? Don’t Act Surprised

Treasury Secretary Yellen does not see any indicator of an imminent recession. She isn’t looking. The normal economic tailwinds have calmed and, as predicted, Biden's economic policies are a significant headwind.

A recession is sometimes defined as a reduction in the number employed nationally for a couple of months. Other times it is defined as a reduction in real GDP for two quarters or more.

When it comes to predicting events like this, my recursive approach is to first understand where the general trends are heading. In technical terms, is the economy’s “steady state” above or below where we are now, and how much? If the trends are strong up, small perturbations around that trend will not make a recession. If the trends are flat, then even a small negative shock will create a recession by one or more of the definitions. Which definition will be triggered can be assessed by contrasting employment trends with productivity trends.

Four important trends are worth considering: organic productivity growth, organic population growth, recovery from the pandemic recession, and new public policies affecting productivity, population, or employment.

Organic trends

Given that recessions are defined in absolute rather than per capita terms, population growth is normally an economic tailwind. However, annual adult population has fallen from a bit above one percent 1980-2018 to about 0.4 percent. Illegal immigration is a wild card here because we do not know how many are immigrating, what fraction are adults, and whether and how those adults will be economically engaged. With that caveat, we now are in a situation where even a small negative shock that would not have caused a recession in the one-percent population growth era will now.

Recovery from the pandemic was also a tailwind. It someday will continue to lift employment, but at the moment it looks like employment has recovered as much as it can given the serious health problems encountered during the pandemic, including but not limited to self-destructive substance abuse habits that are not complementary with productive employment. Some of these people will show up on payrolls but how reliably they show up for work is another question. Diabetes, liver disease and heart disease have gotten out of control since 2020.

Workers lost skills and capital laid idle during the pandemic. These are recovering, although their recovery will not be fully recognized in the growth data. GDP and productivity levels were exaggerated during the pandemic as many goods were unavailable or low quality in ways not captured by the national accountants. For example, public school teachers stayed home from school but the national accountants assumed that they were as productive as ever merely because they continued to get paid. As they get back to traditional teaching, this will not be officially recognized as economic progress for the same reason the pandemic regress was never acknowledged.

Crime has gotten bad, especially in big cities where productivity is normally the highest. Consumers and businesses are avoiding big cities, which is a cost (“excess burden”) beyond the crime statistics because the whole point of the avoidance behaviors is to keep from being one of those statistics.

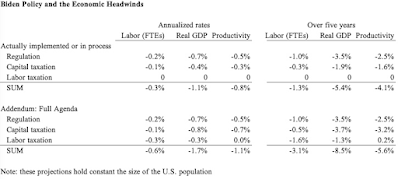

Fitzgerald, Hassett, and I predicted in 2020 that Biden’s economic agenda would reduce the levels of full-time equivalent employment per capita by 3.1 percent and real gdp per capita by 8.5 percent. If that level effect were spread over five years, that would be 0.6 percent per year and 1.7 percent per year, respectively, as shown in the Table as an addendum panel. That by itself makes a recession likely in one of those five years.

Regulatory Policy

Our analysis of Biden’s agenda distinguished regulation from capital taxation from labor taxation. His regulatory agenda seems to be going ahead as we expected. The good news is that Biden’s nomination of David Weil to the Department of Labor was rejected by the Senate and Biden was slow to fully mismanage the National Labor Relations Board. But we did not anticipate that Biden’s DOL would disrupt labor markets as much as it did with its mask mandates. Sticking with our original estimate, it looks that Biden’s regulatory agenda is reducing employment by 0.2 percent per year (of five years) and real GDP by 0.7 percent per year below the organic trends. See the Table’s top panel.

Of particular concern over the next few months is the reliability of the electric grid and air travel. Snafus of this type are already built into our regulatory analysis but these examples put more texture on the economic reasoning that links the marginal regulations with poor economic performance.

Capital Taxation: Inflation Sneaks In

Biden’s Build Back Better bill would implement much of the capital taxation we envisioned in 2020. The good news is that the bill has not yet passed, and passage of its capital tax elements are not imminent in some other form. The bad news is that inflation is taxing businesses without any Congressional action (recall Feldstein and more recently Hassett on the effect of inflation on the cost of capital), while it appears that Biden will let temporary provisions in the 2017 TCJA expire. With capital taxation during the Biden administration increasing about half of what we expected, it would reduce real GDP by about 0.4 percent per year over five years.

Speaking of inflation, higher Fed Funds rates are already showing up in mortgage rates. In effect, the Federal Reserve is introducing a tax (or cutting a subsidy) on structures investment, which is likely to send at least that sector into a recession. Socially responsible (a.k.a., woke) investing is also skewing the allocation of capital.

Combining capital taxation and regulation, the headwinds in the Biden economy are 0.25 percent per year for employment and 1.1 percent per year for real GDP.

Labor Taxation: Direction Unclear

Labor taxation is an interesting wild card here. Marginal tax rates on work were cut sharply when the $300 weekly unemployment bonus expired last summer. That effect has played out already. But I expect that Congressional Democrats, and even some Republicans, will expand unemployment benefits if anything resembling a recession were occurring. That could easily and quickly reduce employment by one percent, if not more. On the other hand, various federal health insurance subsidies are about to expire. If they do (without resurrection), that will encourage work.

Bottom Line

Overall, a recession is highly likely with so many headwinds and so few tailwinds. A recession is more likely by the GDP definition than the employment definition. The depth of the recession depends on how much Congress destabilizes things by further adding to the already large federal portfolio of programs for the unemployed and poor and further adding to tax burdens.

Friday, April 8, 2022

Is the Missing ERP Revealing Bad News about Biden's Health?

15 USC 1022(a) requires

"The President shall annually transmit to the Congress not later than 10 days after the submission of the budget ... an economic report (hereinafter in this chapter referred to as the “Economic Report”) together with the annual report of the Council of Economic Advisers...."

Because the budget was submitted March 28, 2022, yesterday was the due date for submitting the 2022 Economic Report of the President. No report has been released in 2022 and neither the White House nor news media have said anything about this year's report.

CEA, like many other government agencies, is funded with public money. It should perform its duties as directed by the public through the statutes duly enacted by its representatives in Congress.

Moreover, CEA is unique from most of the rest of the Executive Office of the President in that it is explicitly created and directed by federal statutes. As it should, this unique statutory basis has elevated CEA's influence within the White House. But if CEA does not comply with the law, what stops the rest of the bureaucracy from treating CEA as just one of many White House Offices and Councils whose entire existence could be erased at the whim of the President or senior staff?

Why the lack of compliance with 15 USC 1022(a)? Here are my guesses, beginning with those I assess to be most likely.

- Biden, who must at least meet with CEA and sign the report, is too feeble to perform all of the duties required of him by law and politics. Senior staff have made the tough decision as to which laws will not be followed in order to reserve Biden's energy for other duties.

- I am not the only one to notice that it has been a month since Biden had anything on his public schedule later than mid-afternoon.

- This theory predicts that no EOP employees get fired.

- Biden's senior staff views statutes as mere suggestions, and therefore even a minor logistical challenge would be enough to ignore 15 USC 1022(a).

- This is consistent with the fact that the FY 2023 budget (an OMB product) missed the statutory deadline too, which has occurred before when a President was just coming into office or when the deadline occurred during a government shutdown but (I think) is otherwise unprecedented.

- Expected punishment is low, under the theory that a Democratic Congress would not hold a Democratic administration accountable.

- This possibility is the worst for (among other things) the CEA as an institution because then CEA itself becomes a mere suggestion.

- The draft ERP, which likely began in early 2021, contains something that in hindsight is terribly embarrassing to the Biden administration. It either needs to be rewritten or released on a day when other news distracts all of the attention. This is bit unlikely, because the embarrassment would have to be something that the ERP covers that the (much longer) President's Budget does not. On the other hand, this explanation is complementary with the Biden-debilitation story because likely the President would be needed to adjudicate a serious dispute among senior staff. [More generally it would be interesting to know how disputes are resolved when POTUS is debilitated. Does VPOTUS help?]

- The current CEA is unaware of 15 USC 1022(a) and what actions are required to comply with it. I doubt this because the CEA chair, Cecilia Rouse, was a CEA member who had helped prepare two prior ERPs (2010 and 2011).

- The current CEA is aware of 15 USC 1022(a) and the actions are required to comply with it, but proved incapable of doing its part. I doubt this even more because that puts the President in jeopardy and an army of former CEA staff could have been called to help on a volunteer basis. More time could have been obtained by going downstairs and asking OMB to delay its budget release, which itself was already past the statutory deadline.

- Progressives in the administration have objected to even the mildest citation of unintended consequences and the law of demand (mild enough that even Jared Bernstein insists that they be mentioned). Such objections could likely exist, but very unlikely stop the lawful ERP transmittal because

- The CEA chair had much time to engage in earnest debate with the rest of the administration (as CEA 45 often did, sometimes for more than a year). In the end she could assert her statutory authority to issue the ERP as she and POTUS see fit.

- Possibly the CEA chair would be willing to fudge the economics for the progressive cause, and therefore the dispute would not be reason to miss the statutory deadline.

- The Joint Economic Committee is the statutory Congressional receiver of the annual ERP. The hard copies, which is usually provided to JEC on the official "day of transmittal," was not delivered until April 25, 2022. This observation adds support to the Biden-disability theory because POTUS at least signs the hard copies.

- On the other hand, the excellent CEA45 production editor, Al Imhoff, also served in that role for ERP 2022 (see p. 345). The fact that a second production editor was hired (Kellam worked on Obama-era ERPs) suggests that CEA46 was so late writing its chapters that there was no time for Imhoff to serially process them as he did for CEA45. This hypothesis is also consistent with the fact that many more of CEA45's chapters were released as stand-alone public reports throughout the year (Imhoff was copy editing many of those too), some of which could be entered into ERP production 4-5 months ahead of the statutory deadline.

Tuesday, April 5, 2022

New Emissions Regulations are Coercive Paternalism, not Environmental Science, or even Benevolent Paternalism

Trump's CEA showed, based on credit transactions among manufacturers, that vehicle standards to abate a ton of CO2 cost about $163 on the margin, while even Obama said the abatement was worth only $50. i.e., tightening emissions regulations fails a cost-benefit test by a wide margin.

Now Biden claims that new stricter standards pass a cost benefit test. Although this will be cast as an environmental issue, the new conclusion is driven by assumptions unrelated to environmental economics or climate science:

(1) Consumer fuel savings get (mostly) double counted because "behavioral economics." Specifically,

"The agency’s analysis assumes that potential car and light truck buyers value only the savings in fuel costs from purchasing a higher-MPG model they expect to realize over the first 30 months they own it. Depending on the discount rate buyers are assumed to apply, this amounts to 25-30 percent of the expected savings in fuel costs over its entire lifetime." (p. 420 of DOT's final rule)

This double counting (100 - 27.5% = 72.5% of $98 billion in fuel savings) is more than quadruple the purported $16 billion net benefit shown in Table VI-11 of the final rule.

[I call it double counting because, by the principle of revealed prevalence, fuel savings is already built into the price and sales of fuel-efficient vehicles; many consumers do not purchase such vehicles because of the relative price and characteristics of competing vehicles. Alternatively, you could say that DOT ignores benefit of low-MPG vehicles, but the revealed-preference result is the same.

Following an Economics 301 homework solution from October 2019, in December 2020 Trump's CEA provided a vector proof -- that the market price for GHG credits (i) reflects fuel savings as consumers perceive them and (ii) fully quantifies the industry-level real GDP effects of changing GHG standards, without any additional term for fuel savings -- on the White House website. See the appendix of this document.]

By comparison, the gross climate benefit is purportedly $27.5 billion. i.e., they would have to more than double their already inflated "social cost of carbon" to push their thumb on the scale as vigorously as they did with "behavioral economics." See below for more on paternalism.

(2) Biden says that some tightening comes for free because 5 manufacturers had already signed a pledge with California EPA to so tighten

But this ignores that California rules, when followed by just a subset of manufacturers, do not reduce the supply of federal credits, whereas changes in federal rules do even if the federal rules are not as strict as California's. The equilibrium credit price is built into the prices paid by purchasers of new cars.

(3) When the above are enough to tilt the scale, all costs and benefits are discounted 3%/yr. When an extra push is needed, Biden discounts environmental benefits at 2.5% per year while everything else is discounted 3%/yr.

"the use of the social rate of return on capital ... inappropriately underestimates the impacts of climate change for the purposes of estimating the SC-GHG. ... the consumption rate of interest is the theoretically appropriate discount rate in an intergenerational context." (p. 547 of the Technical Support Document. See also p. 573 of the final rule.)

More on coercive paternalism

Trump's DOT and EPA spoke forcefully against paternalism as a justification for fuel standards. If people lack knowledge, give them the knowledge rather than imposing a decision on them. Here is how they said it

"the idea that regulating fuel economy and CO2 emissions can mitigate the consequences of inadequate access to information by placing decisions that depend on access to complete information in the hands of regulators rather than buyers has superficial appeal. Yet commenters do not establish that such a drastic step is necessary to overcome any inadequacy of information, or that requiring manufacturers to supply higher fuel economy will be more effective than less intrusive approaches such as expanding the range of information available to buyers." (85 FR 24608, italics added)

In contrast, Biden's DOT and EPA say nothing like this, but instead extol the purported virtues of "behavioral economics." They do not mention less intrusive approaches, let alone show why they would have fewer net benefits.

Saturday, April 2, 2022

White House Economic Analysis of Ukraine

The 2019 Economic Report of the President includes the most extensive economic analysis of Ukraine of any President going back at least to Truman. It discussed:

- Historical harms -- including murder -- imposed on Ukraine by Moscow (Chapter 8),

- The extensive costs of the collective ownership imposed on Ukrainian agriculture, asking why would collective ownership of healthcare work out any better if the economic incentives were the same (Chapter 8),

- How the New York Times covered up and lied about events in Ukraine because the events were incongruent with the leftist fantasies of many of its readers (Chapter 8). Pulitzer Prizes were awarded for those lies!

- Ukrainian energy trade (Chapter 5).

- The 1993 ERP noted that Ukraine was among former Soviet republics issuing its own currency in 1992 (pp. 304-5).

- The 1994 ERP noted that "[CEA member] Stiglitz traveled to Russia and Ukraine and established an official relationship with the Russian Government's Working Center for Economic Reform." (p. 256)

- The 1995 ERP noted that the U.S. engaged in several bilateral investment treaties, including "treaties with the former Soviet republics of Georgia, Ukraine, and Belarus." (p. 249).

- The 1997 ERP cited Ukraine in a list of many countries allocated "U.S. non-military bilateral aid" and that in the case of Russia and Ukraine, this aid was for "public health programs" (pp. 264-5). It also cited the "explosion at Chernobyl" as part of a paragraph about "how developing countries treat their environment." [I wish the 2019 ERP had included a section on environmental stewardship by socialist countries, but the idea did not occur to me until much later. The environmental rhetoric was much the same as modern-day socialists'].

- On page 167 of the 1998 ERP, it was noted that Ukraine was one among several countries assigned "less stringent" emissions limits by the Kyoto protocol. On page 259, a large list of countries receiving U.S. aid was listed, including Ukraine.

- On page 290 of the 1999 ERP, it was noted that currency boards have been recommended for countries such as "Indonesia, Russia, and Ukraine."

- Page 260 of the 2001 ERP reports that CEA "initiated a new dialogue with economic officials in Ukraine."

- Page 131 of the 2005 ERP includes a box about "The Benefits of Land Titles." Several countries are mentioned in the box, with Ukraine as one of those where "entrepreneurs believe their property rights are secure [and therefore] reinvest ... back in their business."

- In a paragraph about the "disadvantages to nuclear power," p. 172 of the 2008 ERP cites the "Chernobyl nuclear power plant in Ukraine."

- The 2010 ERP notes the rapid deprecation of "the currencies of Hungary, Poland, and Ukraine" (p. 86).

- A footnote on p. 130 of the 2012 ERP explains which countries are included in its emerging markets index. Ukraine is one of 21.

- Figure 1-4 of the 2014 ERP has international comparisons of quarterly real GDP time series. Ukraine is one of the countries included. A similar chart is repeated on page 117.

Wednesday, March 30, 2022

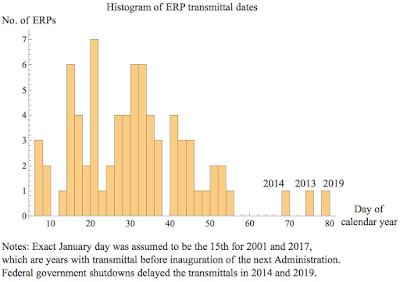

The Most Tardy ERP in History

The White House Council of Economic Advisers' Annual Report, a.k.a., Economic Report of the President, has not yet been transmitted to Congress as of today, the 89th day of 2022.

This is the latest ERP transmittal ever, with the previous record being 2019, which was transmitted on the 78th day (signed on the 77th -- see photo below) following a prolonged federal government shutdown.