The taxation of business income is now increasing significantly, without any action from Congress. The increase can be understood as two forces acting through one simple formula.

For tax purposes, depreciation is a statutory time path of deductions from a business' taxable income for each dollar invested in a real asset. The path is called "depreciation" because the undiscounted present value of that time path is equal to one. That is, 100 percent of every dollar invested will someday be available as a deduction.

One simple formula representing two shocks: D/(D+R)

An important reason that business-income taxation distorts investment is that business owners evaluate time paths at a discount rate R > 0. Therefore, in present value, only a fraction (z, in the usual notation) of investment is deductible from taxable income.

With constant depreciation (D) and discount (R) rates, z = D/(D+R) <= 1. This simple formula captures two things going on right now in the U.S.: the sunsetting of TCJA's bonus depreciation and inflation. (The former is specific to the U.S. but the latter is relevant for those nations that also tax business income while allowing depreciation deductions).

TCJA allowed the expensing of some investment, which makes z = 1 (think of expensing either as R = 0 or infinite D). Expiration of expensing pushes z below one.

The depreciation schedule is a nominal time path; depreciation allowances are not indexed for inflation. Therefore the appropriate discount rate R is a nominal interest rate. Clearly nominal interest rates have increased over the past year and a half (inflation!), which reduces z in all but the expensing case. Indeed we can ignore the expensing case if we take the sunsetting first and then add in inflation.

Quantitative results

In order to translate reductions in z into increases in the effective real price of investment, I use a special case of the Hall-Jorgenson formula, where the pre-tax real price is inflated by the tax factor (1-tz)/(1-t) <= 1, were t is the statutory rate of taxation of business income (Cohen, Hassett, and Hubbard consider the more realistic, but also more complicated, cases). The equality holds only when z = 1 (i.e., expensing).

The chart below shows the relation between the nominal interest rate R and the tax factor. We start close to the origin with low inflation and bonus depreciation. Sunsetting by itself moves off the origin to (pre-inflation) R of, say, 2-3%/yr. That is about a 7 percent increase in the real price of investment.

Next inflation increases R. So far annualized R appears to have increased about 2 percentage points although there are concerns that it could increase more (presumably it would increase close to 1-for-1 with inflation if inflation were expected to be permanent). That increases the real price of investment another 4 percent or so.

Inflation further increases the real price of investment due to personal income taxation, especially to the extent that personal income is taxed at higher personal rates than business income is. On the other hand, the sunsetting of expensing is not relevant for structures because they did not get bonus depreciation. So perhaps all three effects combined increase the price of investment 15 percent, with about half specific to TCJA.

Oil and gas

Oil and gas extraction is particularly capital intensive. Using a capital share of 71 percent, that suggests an 11 percent shift (upward) in the marginal cost for that industry, with about half due to TCJA subset and therefore not shared by foreign producers of oil and gas.

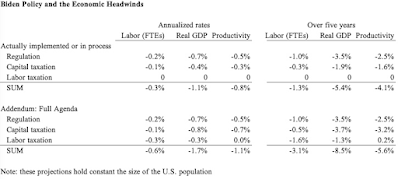

Comparing the period of the Biden presidency (Feb 2021 - Feb 2022, which is latest available) to 2018-19, inflation-adjusted world oil prices have increased 20-25 percent while US O&G industry marginal cost has shifted up 11 percent. That by itself would blunt much of the supply response. Then add:

- new threats of federal energy and banking regulation,

- threats to increase the statutory rate on business income, and

- the effects of ESG investing that increasingly stigmatizes investment in fossil fuels,