Copyright, The New York Times Company

A few economists have likened the commercial real estate market of the 2000s to the housing cycle. In fact, the commercial and housing markets were fundamentally different.

As recently as last week (see also here), Paul Krugman has claimed that the commercial real estate market followed a “bubble” much like that of the housing market, and thereby concluded that the housing bubble cannot be blamed on anything unique to the housing sector.

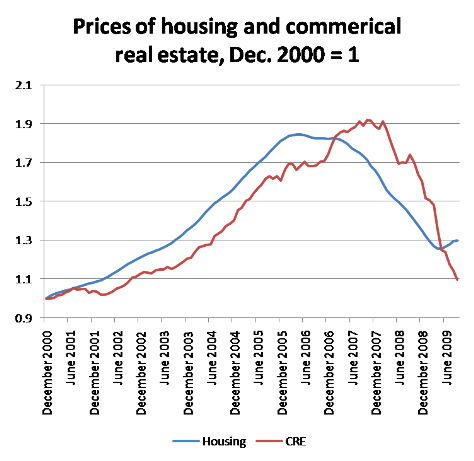

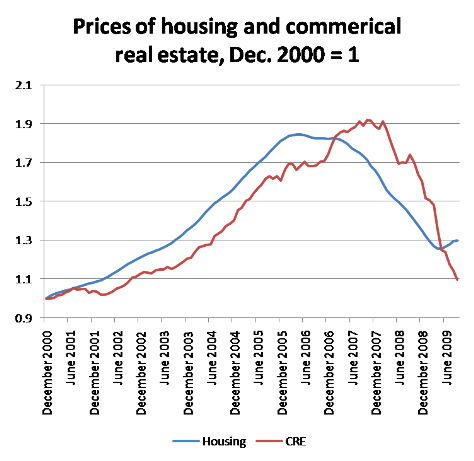

Mr. Krugman observed that real estate prices went up, and then came down, in both the residential and non-residential sectors. For example, he has presented the chart below comparing the Case-Shiller index for housing prices with a commercial real estate price index from Moody’s.

In Mr. Krugman’s view, both “bubbles” had some of the same determinants. For example, lenders were hungry for risk, and they fed their appetites by investing in a variety of assets, like houses and office buildings. Thus, he takes comfort in his observations that the two sectors had real estate prices that moved roughly together.

I have long disagreed with his interpretation, arguing instead that the housing and commercial real estate cycles had very different determinants. Housing boomed for residential-specific reasons, such as technical change biased toward homes, home-buyer optimism or lax home-mortgage standards.

The housing price boom led to a jump in home construction, which pulled resources (workers, materials, and land) away from the commercial sector. Commercial real estate construction was low during the housing boom, and only began to recover after 2005, once housing busted and construction workers and other resources were free to work on commercial projects. (The commercial recovery in 2009, however, was limited by conditions in the wider economy, such as the fact that fewer business were hiring and therefore in less need of space in which their employees could work).

If Mr. Krugman were right, construction activity should have boomed (and then busted) at more or less the same time in housing as in commercial real estate.

Thus, one way to distinguish my hypothesis from Mr. Krugman’s is to look at construction activity separately by sector. The chart below displays monthly private residential and non-residential construction spending from January 2000 to October 2009.

Of course, housing construction spending increased dramatically during the housing boom (2002 through 2006), and collapsed during the bust.

We see the opposite pattern for nonresidential construction spending, which failed to increase before 2006, despite the fact that nonresidential construction spending trended up in previous decades. Nonresidential construction spending increased significantly only once residential spending turned downward in 2006.

Mr. Krugman’s price observation is a red herring, because commercial real estate prices should have followed a cycle like housing prices did, even if the housing boom was caused by factors specific to housing.

First of all, commercial real estate prices should reflect the costs of constructing commercial buildings, which increased during the housing boom (and then fell during the housing bust) because so many construction resources were being used for building homes.

Moreover, some commercial buildings can be converted to residential buildings, and conversions were common during the housing boom. This is another reason why a residential-based boom would show up in commercial real estate prices.

Thus, I see little evidence of a commercial real estate bubble that was inflated with the same fuel as the housing boom. Rather, commercial real estate seemed to be reacting to the situation in the housing sector, and in the wider economy.

A few economists have likened the commercial real estate market of the 2000s to the housing cycle. In fact, the commercial and housing markets were fundamentally different.

As recently as last week (see also here), Paul Krugman has claimed that the commercial real estate market followed a “bubble” much like that of the housing market, and thereby concluded that the housing bubble cannot be blamed on anything unique to the housing sector.

Mr. Krugman observed that real estate prices went up, and then came down, in both the residential and non-residential sectors. For example, he has presented the chart below comparing the Case-Shiller index for housing prices with a commercial real estate price index from Moody’s.

In Mr. Krugman’s view, both “bubbles” had some of the same determinants. For example, lenders were hungry for risk, and they fed their appetites by investing in a variety of assets, like houses and office buildings. Thus, he takes comfort in his observations that the two sectors had real estate prices that moved roughly together.

I have long disagreed with his interpretation, arguing instead that the housing and commercial real estate cycles had very different determinants. Housing boomed for residential-specific reasons, such as technical change biased toward homes, home-buyer optimism or lax home-mortgage standards.

The housing price boom led to a jump in home construction, which pulled resources (workers, materials, and land) away from the commercial sector. Commercial real estate construction was low during the housing boom, and only began to recover after 2005, once housing busted and construction workers and other resources were free to work on commercial projects. (The commercial recovery in 2009, however, was limited by conditions in the wider economy, such as the fact that fewer business were hiring and therefore in less need of space in which their employees could work).

If Mr. Krugman were right, construction activity should have boomed (and then busted) at more or less the same time in housing as in commercial real estate.

Thus, one way to distinguish my hypothesis from Mr. Krugman’s is to look at construction activity separately by sector. The chart below displays monthly private residential and non-residential construction spending from January 2000 to October 2009.

Of course, housing construction spending increased dramatically during the housing boom (2002 through 2006), and collapsed during the bust.

We see the opposite pattern for nonresidential construction spending, which failed to increase before 2006, despite the fact that nonresidential construction spending trended up in previous decades. Nonresidential construction spending increased significantly only once residential spending turned downward in 2006.

Mr. Krugman’s price observation is a red herring, because commercial real estate prices should have followed a cycle like housing prices did, even if the housing boom was caused by factors specific to housing.

First of all, commercial real estate prices should reflect the costs of constructing commercial buildings, which increased during the housing boom (and then fell during the housing bust) because so many construction resources were being used for building homes.

Moreover, some commercial buildings can be converted to residential buildings, and conversions were common during the housing boom. This is another reason why a residential-based boom would show up in commercial real estate prices.

Thus, I see little evidence of a commercial real estate bubble that was inflated with the same fuel as the housing boom. Rather, commercial real estate seemed to be reacting to the situation in the housing sector, and in the wider economy.

9 comments:

Dr. Krugman wants to take u hunting.

Tishman deal fails: sign of trouble in commercial real estate... hmmm

I recently came across your blog and have been reading along. I thought I would leave my first comment. I don't know what to say except that I have enjoyed reading. Nice blog. I will keep visiting this blog very often.

Alena

http://mortgagecalculato-r.com

Mr. Krugman empiric that absolute acreage prices went up, and again came down, in both the residential and non-residential sectors.

California Property Management

The leads for technological improvement are naturally unclear, so that their effects might be amplified by “irrational exuberance,” financial assistance, or both. For example. bubblegum casting

predicted to improve as a growing fraction of the population chose to work from house, amuse at house, and otherwise requirement more property. But this document also points. bubblegum casting

I don't think so. Now a days the demand for real estate is increasing day by day.

Flagler - Lease & Sale Office Space, Miami

When some thing goes wrong together with your hotel REMAIN, the first strategy is to boost the issue using the hotel clerk the moment the issue is found bubblegum casting

If the property cycle is to be linked to fundamentals, then it must be explained why. new real estate developments

Post a Comment