- Productivity based: -2.2%

- Income based: +0.4%

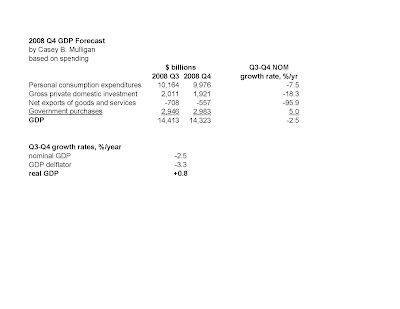

- Spending based: +0.8%

The productivity forecast is the simplest: I take the -7.4 %/yr decline in aggregate work hours and assume that productivity rises via a movement up the labor demand curve, which yields -5.2%/yr. The pundits appear to stop here, assuming no productivity growth for a given amount of labor. But productivity has been increasing throughout this recession, so why should it stop now?! Thus I get -2.2%/yr.

The forecasts based on income and spending are shown in more detail below. In terms of the income account, the fairly strong aggregate payroll spending (as indicated by BEA and by Treasury payroll tax collections) are my reasons for optimism. In terms of the spending account, my optimism comes from net exports and my view that this recession's investment decline will be MILD.

I do not want to exaggerate the degree of precision any of us have -- the gap between my most and least optimistic forecast is only about $75 per person. The gap between Goldman and my least optimistic forecast is also about $75 per person. But there is no doubt that I see Q4 a lot differently than do the pundits.

Note: I have been saying for a while (e.g., here) that real GDP may well grow Q3 - Q4. All that is new today is that I have organized the details well enough to post here.

No comments:

Post a Comment