Much conventional wisdom among econometricians and applied economists extols the virtue of "panel data": data that follows individuals or regions over time. State panel data -- data that follows each of the 50 states over time, is thought to be especially virtuous because there's never a problem with losing track of one of the states (unlike panels of individuals, from which members can nonrandomly drop). Especially lauded is the practice of including so-called "time effects" in the model, which means that changes over time are NOT examined except to the extent they occur differently among the individuals or regions.

One interesting question in industrial organization and public economics is the "incidence" of excise taxes -- that is, whether a tax on the sales of specific items will reduce what manufacturers receive for making the item, or increase what consumers pay for it. Cigarettes are an important instance of this, because the taxes are large, and policy-makers are concerned about the harmful health effects of smoking. Because the effects of taxes are determined by the interaction of supply and demand, knowledge of cigarette tax incidence would tell us about the nature of pricing in the cigarette industry, as well as effects of federal cigarette taxation on health and state revenues.

Cigarette tax incidence has usually been studied with state panel data. After all, states differ widely in terms of their use of their taxes, and the dates at which they change their rates. The state panel studies usually find that each penny of cigarette tax raises retail cigarette prices by almost exactly a penny, with little effect on the price per unit received by manufacturers.

By this logic, the $0.62 per pack federal excise tax hike this April would raise retail cigarette prices by almost exactly $0.62 per pack, reduce cigarette smoking in an amount commensurate with the $0.62, and have little effect on the amount cigarette manufacturers receive per pack shipped to U.S. retailers.

I have long been dubious of state panel data for this purpose, because the supply curve across states is very different than the national supply curve. Wholesalers in one state can pretty easily ship cigarettes to a wholesaler in a state with a different tax situation, and this possibility requires wholesale cigarette prices to be essentially the same in each state at a point in time. National pricing is very different because nothing requires the wholesale price in, say, 2006 to be the same as it is in 2009 (I'm told that cigarettes do not store well over long time periods).

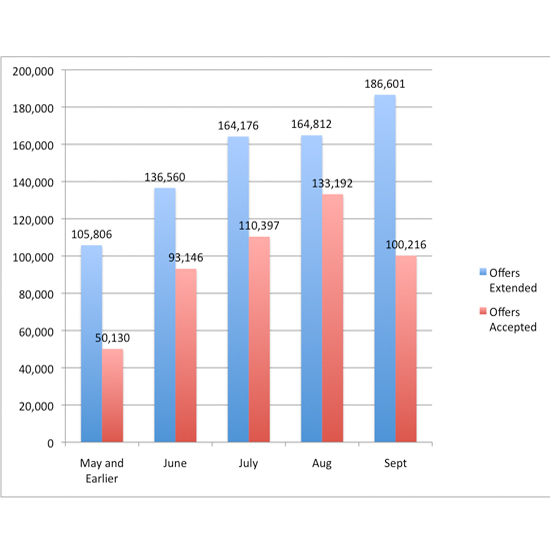

We have enough data now to check whether I'm right. I found a monthly Consumer Price Index for cigarettes at www.bls.gov. The CPI is an index, telling us percentage changes in retail prices from one month to the next, but do not tell us what a pack actually costs. The aforementioned literature often gets annual (measured in November) cigarette prices from the "Tax Burden on Tobacco", so I used that to pin down the level of national average cigarette prices in Nov 2007 ($4.20 per pack; see also this article that puts average prices at $4.10 in early 2009), and then used the monthly CPI to measure retail prices for all other months Jan 2007 - Oct 2009.

The chart below displays the results. Notice that the vertical axis is scaled so that each tick is $0.62/pack -- if the state-panel studies could be used to project federal tax effects, then prices would go up by exactly one tick.

Instead, cigarette prices increased a lot more than 62 cents: more like $1. The state-panel results wildly underestimate the effect of the tax on retail prices, and thereby wildly underestimate the effect of the federal tax on smoking and excise tax revenues received by the states.

[The vast majority of states kept their excise tax rates constant during the first half of 2009. Exceptions are Arkansas, Kentucky, Mississippi, and Rhode Island.]

One interesting question in industrial organization and public economics is the "incidence" of excise taxes -- that is, whether a tax on the sales of specific items will reduce what manufacturers receive for making the item, or increase what consumers pay for it. Cigarettes are an important instance of this, because the taxes are large, and policy-makers are concerned about the harmful health effects of smoking. Because the effects of taxes are determined by the interaction of supply and demand, knowledge of cigarette tax incidence would tell us about the nature of pricing in the cigarette industry, as well as effects of federal cigarette taxation on health and state revenues.

Cigarette tax incidence has usually been studied with state panel data. After all, states differ widely in terms of their use of their taxes, and the dates at which they change their rates. The state panel studies usually find that each penny of cigarette tax raises retail cigarette prices by almost exactly a penny, with little effect on the price per unit received by manufacturers.

By this logic, the $0.62 per pack federal excise tax hike this April would raise retail cigarette prices by almost exactly $0.62 per pack, reduce cigarette smoking in an amount commensurate with the $0.62, and have little effect on the amount cigarette manufacturers receive per pack shipped to U.S. retailers.

I have long been dubious of state panel data for this purpose, because the supply curve across states is very different than the national supply curve. Wholesalers in one state can pretty easily ship cigarettes to a wholesaler in a state with a different tax situation, and this possibility requires wholesale cigarette prices to be essentially the same in each state at a point in time. National pricing is very different because nothing requires the wholesale price in, say, 2006 to be the same as it is in 2009 (I'm told that cigarettes do not store well over long time periods).

We have enough data now to check whether I'm right. I found a monthly Consumer Price Index for cigarettes at www.bls.gov. The CPI is an index, telling us percentage changes in retail prices from one month to the next, but do not tell us what a pack actually costs. The aforementioned literature often gets annual (measured in November) cigarette prices from the "Tax Burden on Tobacco", so I used that to pin down the level of national average cigarette prices in Nov 2007 ($4.20 per pack; see also this article that puts average prices at $4.10 in early 2009), and then used the monthly CPI to measure retail prices for all other months Jan 2007 - Oct 2009.

The chart below displays the results. Notice that the vertical axis is scaled so that each tick is $0.62/pack -- if the state-panel studies could be used to project federal tax effects, then prices would go up by exactly one tick.

Instead, cigarette prices increased a lot more than 62 cents: more like $1. The state-panel results wildly underestimate the effect of the tax on retail prices, and thereby wildly underestimate the effect of the federal tax on smoking and excise tax revenues received by the states.

[The vast majority of states kept their excise tax rates constant during the first half of 2009. Exceptions are Arkansas, Kentucky, Mississippi, and Rhode Island.]