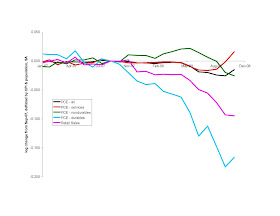

The "disaster" here seems to be isolated to durable goods. Of course, we are nauseatingly aware of the automaker woes. But real services (over 60 percent of total consumption expenditure) are actually higher.

- per capita consumption expenditures (all types, deflated by CPI-all) were up in November for the first time since April. This is the largest monthly increase in more than seven years.

- per capita durable consumption good expenditures (deflated by CPI-durables) were flat in November

- per capita services expenditures (deflated by CPI-services) were up in November, for the 20th month in a row

- per capita retail sales (deflated by CPI-all) were pretty flat in November, after 5 straight months of losses

Do we dare entertain the idea that the trough of this recession was in October?

[technical note: I used the CPI for all items to deflate retail sales and PCE - all. The CPIs for durables, nondurables, and services, respectively were used to deflate the components of PCE. I think this is the right approach, but in case you want to see the consumption series deflated with a common deflator (CPI-all), see below. I infer from the monthly inflation rates (Oct-Nov) that fuel costs appear in nondurables: -1.7% (all), +0.0% (durables), -5.1% (nondurables), -0.6% (services) . More on deflators below.]

[added: Today it was reported that

- nominal Dec retail sales are down 5.5-8 percent compared to the same time frame last year. This is a different data source than I used above -- so we have to be cautious with comparisons -- but note that the retails sales data I used have a Nov-Nov change in nominal retail sales of -5.9 percent.

- amazon.com had the best holiday season ever.

So today's data is consistent with the expectation that December's consumption will be as strong as November's.]

[Added Dec 27: Thanks Tegwar for pointing out that the BEA has monthly PCE deflators. The graph below uses them. The news items based on the various PCE deflators are:

- per capita consumption expenditures (all types, deflated by the PCE-all deflator) were up in November for the first time since May. This is the largest monthly increase in two years.

- per capita durable consumption good expenditures (deflated by PCE-durables deflator) increased in November

- per capita expenditures (deflated by category-specific PCE-deflator) were up in November for all three consumption categories

- per capita retail sales (deflated by PCE-all deflator) were pretty flat in November, after 5 straight months of significant losses

why in the world would you deflate PCE by the CPI (whichever cut you prefer) when PCE comes with its own deflator? sure, many of the PCE components are deflated by CPIs when building the PCE deflator, but a good number aren't?

ReplyDeletewhy not use the EU harmonized CPI while you're at it? (okay, that's a crappy shot)

Tegwar -- does the PCE deflator come monthly? If it did, it would be my first choice

ReplyDelete